1099 Fillable Form for 2023

Understanding the complexities of tax filing is essential for all taxpayers. One such crucial document is Form 1099, an official form issued by the Internal Revenue Service (IRS). The form tracks various types of income earned during the tax year, other than wages, salaries, and tips reported on Form W-2. Despite its primary purpose, there is often confusion surrounding where to get a 1099 fillable form for free and how to complete and submit it accurately. Thus, learning about this form's function and importance is critical.

The 1099 Fillable Form Characteristics

Convenience and accuracy are key when it comes to tax filing. This is where a fillable 1099 tax form comes into play. Perhaps the most striking feature of the editable version of Form 1099 is its ease of use. All taxpayers can access, complete, and transmit the form electronically, making the process less cumbersome. With built-in guiding notes to help fill out each section, it essentially minimizes the risk of errors and ensures you report your financial information correctly.

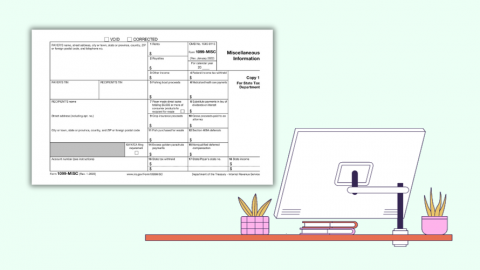

Filing Online 1099 Form Hassle-Free

While an online system streamlines the filing process, it still possesses its inherent challenges. For starters, you must have reliable internet access to operate the system. You may also encounter interface issues, particularly during tax season, as the website experiences high traffic. The fillable Form 1099 also requires you to understand and enter accurate information based on your income statement. It is, therefore, paramount to ensure you have accurate figures before completing the form online.

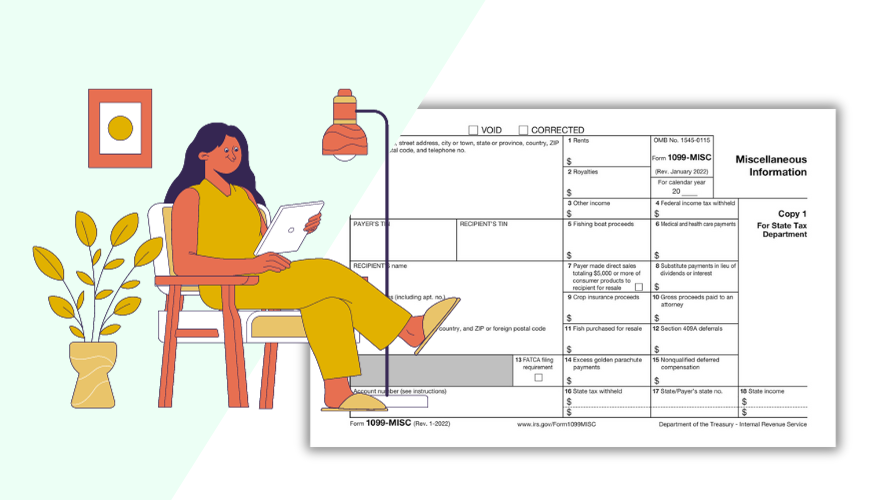

Guidelines to Form 1099 Successful Completion

Here are a few general guidelines for taxpayers while working with the 1099 fillable form in 2023 to ensure its successful completion:

- Ensure you have all the necessary financial documents related to various income sources like dividends, state and federal tax refunds, etc. Have these documents handy before you start filling in the form.

- Thoroughly check and verify all entries, especially those related to income and withholdings, before finalizing and submitting the form.

- Always check the IRS instructions for any updates or changes. This is especially necessary for tax year 2023, as rules and regulations may change depending on the prevailing circumstances.

- Once done, make sure to save a copy of the completed form for your records. Printing a copy is also advisable as it can be useful during audits or in case you need to amend your return in the future.

When dealing with a blank fillable 1099 form, comprehending its function, characteristics, and challenges and carefully following the guidelines can simplify tax management tasks and help you avoid pitfalls and potential penalties from inaccuracies or tax filing errors. With careful planning and accurate data entry, you can conveniently file your taxes and remain confident in your financial records.

Latest News

-

![IRS Form 1099 (PDF) - Overview]()

- 28 September, 2023

-

![Free Blank 1099 Form - Filling Instructions]()

- 27 September, 2023