IRS Form 1099 (PDF) - Overview

Getting to grips with tax paperwork can sometimes feel like navigating through an ocean without a compass. However, one crucial tool in your tax toolkit is the 1099 form. Specifically, we will focus on understanding the relevance and details of the 1099 form for 2023 in PDF format.

This document is often called the “IRS tax form for freelancers.” Still, it also comes into play for small business owners, independent contractors, and anyone else receiving income outside of traditional employee wages. It’s used to report different types of income to the IRS, such as rent, freelance work, and royalties.

IRS Form 1099 in PDF - Convenient & Accessible

Regarding accessibility, the IRS has made obtaining Form 1099 quite comfortable and straightforward. In a few words, IRS Form 1099 in PDF format is available on on our website. This format allows taxpayers to easily fill out, save, or print the form, depending on their preferences and needs. It’s readily accessible and entirely paper-free, making it an eco-friendly option and adding to its convenience.

Tax Form 1099: Important Aspects to Note

- Always double-check the details

It's essential to ensure that all the information - payee details, the payer's information, amount, etc., is accurate. - Don't leave any part incomplete

An incomplete form may lead to unnecessary delays in processing or penalties. - Filing deadline

Trailing behind the deadline may activate penalties. Therefore, remember to submit before the IRS set cut-off date.

Understanding these critical points helps minimize frequent errors made when filling out the free 1099 form in PDF format.

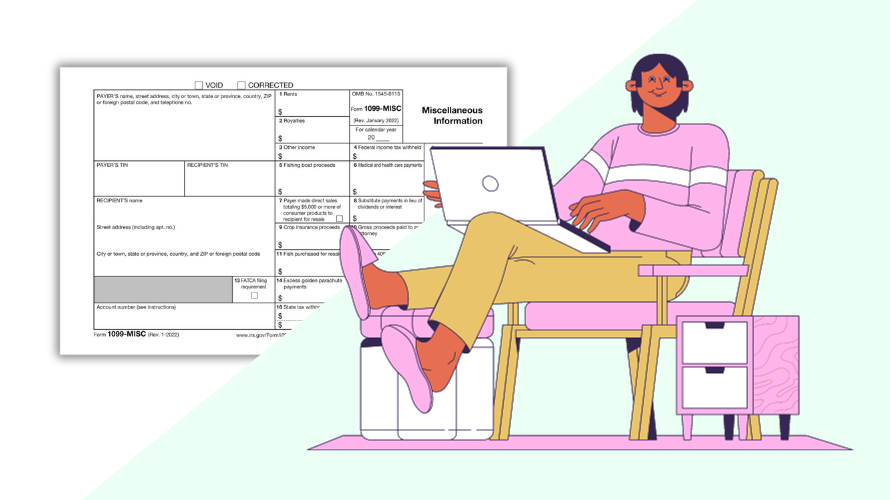

Federal Form 1099 and Some Common Mistakes

While individuals often make certain common mistakes when completing the 1099 form, these can be avoided easily. One common issue is the usage of the wrong form version. The IRS website regularly updates its forms, and it's important always to use the most recent one while filing your taxes. Another common mistake is misreporting the income. Always verify the income amount with your records before you submit it.

Using a printable 1099 form in PDF proves very beneficial here as you can recheck your details conveniently and correct them before printing and posting to the IRS. Navigating your tax requirements need not be an arduous task. By making the 1099 in PDF for download readily available for taxpayers, the IRS has made income reporting a lot simpler and more accessible.

Get ahead of the 2023 tax season by understanding your tax forms now. Remember, the taxpayer who is prepared is the taxpayer who sails smoothly through the tax season.

Latest News

-

![1099 Fillable Form for 2023]()

- 29 September, 2023

-

![Free Blank 1099 Form - Filling Instructions]()

- 27 September, 2023