Free Blank 1099 Form - Filling Instructions

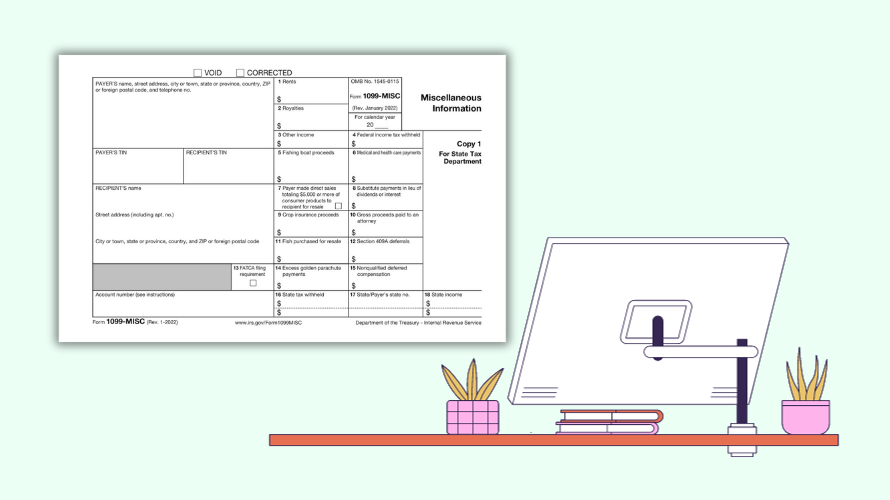

If you've been a part of the financial landscape, you've more than likely come across the words 'Form 1099'. This document is a series of tax forms designed by the Internal Revenue Service (IRS) to report income received by taxpayers, apart from salaries, wages, and tips associated with their employer. This form caters to income streams such as freelancing, dividends, or interest. As part of this comprehensive guide, let's delve into the details and provide useful tips on using the free blank 1099 form.

IRS Form 1099: Historical Context & Key Modifications

Since its inception, the goal of the 1099 form has been to account for various types of income. Over the years, the IRS has introduced modifications to cater to the shifting financial norms and regulations. A significant transition to note is the digitization of these forms. You can now print the 1099 form for free from official IRS websites and other authorized platforms, making it more convenient for taxpayers.

Who is Eligible to Use a 1099 Form?

Not everyone is entitled to use Form 1099. It is specifically targeted at self-employed individuals, investors, and freelancers. If you have earned more than $600 during the financial year as a self-employed contractor, it is mandatory for you to fill a 1099. On the other hand, it's worth mentioning that salaried people who receive a W-2 form from their employer are not eligible.

Obtaining the Blank 1099 Form

The onward march of technology has made it simple and straightforward to access tax forms. For instance, a 1099 form to download for free is available from our website. In addition, there are platforms that enable you to fill out the form digitally, which simplifies the process further.

Mastering the 1099 Income Tax Form

- Start by understanding your specific needs and then select the correct type of 1099 form.

- Ensure that you correctly fill out all the necessary details to avoid discrepancies and potential penalties.

- Printable 1099 form for free versions are available online. Save them, and make multiple copies as needed.

- Consider seeking professional consultancy if you have difficulties understanding the form's specifics. They can guide you to utilize the free 1099 tax form in the best possible way.

In sum, Form 1099 is an essential tax document for freelancers, independent contractors, and investors. Always ensure you track all your earnings accurately and report them for legal compliance and accurate tax estimation. Utilize the available resources, including the printable 1099 form for free, to manage your taxes effectively.

Latest News

-

![1099 Fillable Form for 2023]()

- 29 September, 2023

-

![IRS Form 1099 (PDF) - Overview]()

- 28 September, 2023