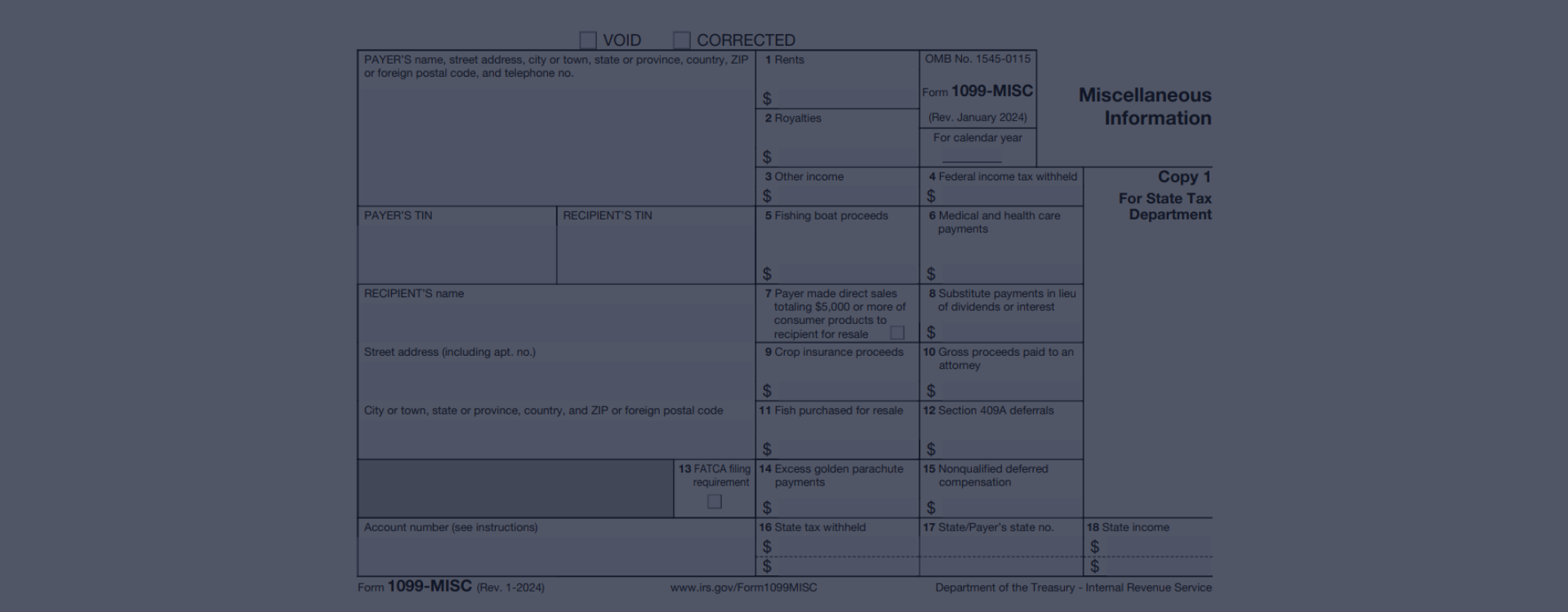

Printable 1099 Tax Form

IRS 1099 Tax Form: Reporting Annual Income with Ease

IRS Form 1099 is an essential document employed in the American tax system. It's primarily used to report various types of income you may receive throughout the year other than regular wages, salaries, or tips. For example, if you're self-employed, the 1099 tax form will be a vital part of your tax reporting, illustrating your income within a given fiscal year.

Our Website Advantages

Our website, 1099-printable-form.net, can provide significant assistance in understanding and completing this critical tax document. With a blank 1099 form for 2023 printable on our website, users can fill out their information directly and conveniently. In addition to this, the website provides printable 1099-MISC form guidelines and examples to make the process even easier. It's precious for self-employed individuals who are responsible for their tax management. Instructions and examples on the site can help mitigate errors and ensure proper form completion, facilitating a smoother process.

The Aim of Federal 1099 Form

Simply put, the printable 1099 form for employees is a vital document in the U.S. taxation system. It's integral to the United States federal taxation system filed by individuals other than full-time employees. This includes freelancers, independent contractors, and self-employed persons, among others.

Let's Imagine...

Consider Gary, a tech-savvy professional who decided to pursue his dream of creating a software development consultancy firm. He works from his apartment in San Francisco and mainly employs freelancers for his different projects. Since the IRS considers him an independent contractor, Gary must file the 1099 form. To keep his finances in check and fulfill his tax obligations, he follows the IRS 1099 form instructions meticulously. As the end of each tax year approaches, Gary promptly ensures all his freelancers receive the 1099 copy. Luckily, he can quickly get the 1099 form printable for free online, saving costs. Thus, with a few steps, Gary successfully handles his taxation-related responsibilities.

Blank 1099 Form for Print: Simple Steps to Fill It Out

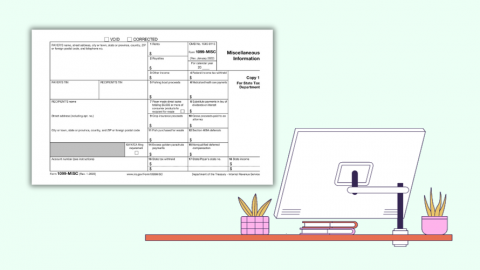

In the world of taxes, correctly filling out documentation is crucial. For independent contractors or self-employed individuals, the 1099 form holds key significance. This guide will outline steps to print the 1099 form for 2023 correctly, breaking it down into manageable sections.

For instance, providing fake data can attract hefty fines. It's vital to remember that the 1099 tax form is not just a piece of paper but a critical financial document. Stay lawful by providing accurate data before the given deadline.

File 1099 Form on Time

Fulfilling your tax obligations promptly is crucial. Generally, the due date to file the federal tax form 1099 printable is January 31st. This document is easily accessible, and for your convenience, it's available as the IRS printable 1099 form in 2023. Avoid delay or default, as the Internal Revenue Service (IRS) can levy penalties for late submissions or fraudulent information.

Federal Form 1099: Popular Questions in 2023

IRS Form 1099 for 2023 - More Instructions

Please Note

This website (1099-printable-form.net) is an independent platform dedicated to providing information and resources specifically about the 1099 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.